Looking for a new bank that can offer you the best promotions and deals? Look no further than Truist Bank as a leading bank in the U.S. with more than 2,500 locations in the South, East, and Midwest with more than 10 million customers.

Truist Bank is currently offering a $400 welcome bonus for new customers for opening Simple Business Checking or Dynamic Business Checking account and make qualify deposit of $1500 or more within 30 days of account opening. More bank promotion here.

With thousands of locations in Alabama, Arkansas, Georgia, Florida, Indiana, Kentucky, Maryland, Mississippi, North Carolina, New Jersey, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, VA, WV, and DC, Truist is now the sixth-largest U.S. commercial bank.

Truist One Checking Bonus: $400 Checking Offer

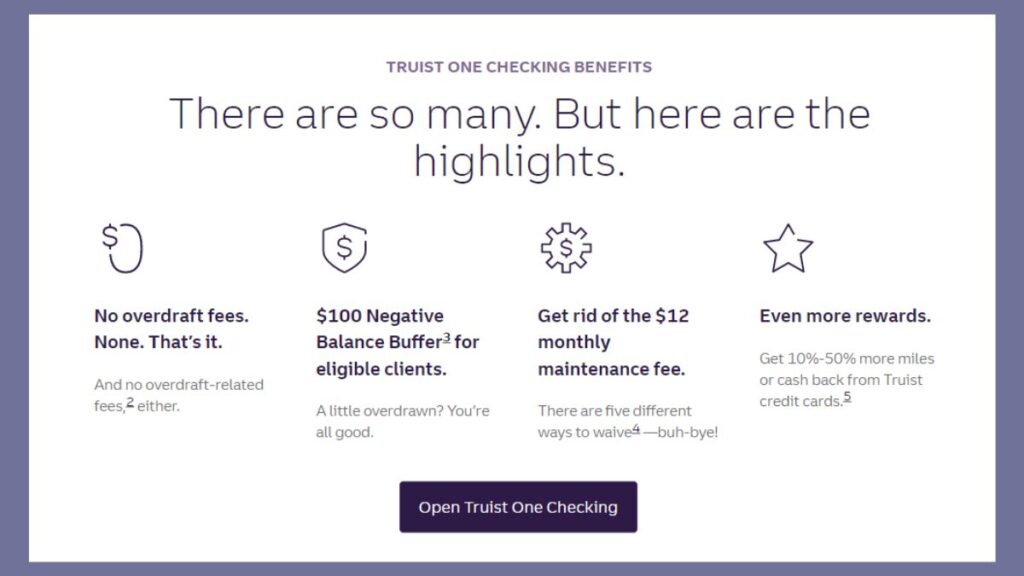

Truist Bank is currently offering a $400 bonus when you open Truist One Checking Bonus using promo code CHKQ123TRUIST1 and make a qualifying direct deposit of $1,000 or more within 90 days of account opening.

Bonus Amount: $400

Account Type: Personal Checking

Location: AL, AR, GA, FL, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV, or DC.

Offer Validation: April 14, 2023

How to earn a Bonus

- Open a new One Checking account online or in-branch using promo code CHKQ123TRUIST1.

- Complete at least two qualifying direct deposits. Deposits need to total $1,000 or more and be made within 90 days of account opening.

- Once the Direct Deposit qualification requirement is verified, the reward will be deposited into the new checking account within four weeks.

What is Truist Bank?

Truist Bank is a major financial institution in the United States. It is a subsidiary of Truist Financial Corporation, which is a Fortune 500 financial services holding company. Truist Bank offers a wide range of products and services, including checking and savings accounts, consumer and business loans, credit cards, mortgages, and more. Truist Bank also offers investment services such as mutual funds and retirement accounts.

Truist Bank has a network of over 2,000 branches and over 800 ATMs across the United States, making it easy to access your banking services. Truist also has an online banking platform that allows customers to manage their accounts and make transfers from anywhere in the world. Truist Bank has been in operation since 1872 and has a long history of providing reliable banking services to its customers.

READ MORE: See Bank Offers From GO2bank, Chime, And Varo Bank

Overview of Truist Bank Products and Services

Truist Bank offers a wide range of products and services to its customers. Its checking and savings accounts come with competitive interest rates and have no monthly maintenance fees. Truist also offers CDs and money market accounts with higher interest rates.

Truist Bank also offers consumer and business loans, including auto loans, home equity loans, and personal loans. Truist Bank also offers a variety of credit cards, including rewards cards, cashback cards, and low-interest rate cards. Truist also offers a range of investment services, including mutual funds, retirement accounts, and financial planning services.

Truist Bank also offers a variety of insurance services, including auto insurance, home insurance, life insurance, and more. Truist also offers banking services to small businesses, including business checking, merchant services, and business loans.

Truist Bank Fees

Truist Bank has competitive fees for its services. Checking and savings accounts have no monthly maintenance fees and no fees for online or mobile banking. Truist Bank’s credit cards also have competitive annual fees and interest rates.

Truist Bank also has competitive fees for its investment services. Mutual funds have no annual fees and are offered at competitive prices. Retirement accounts also have no annual fees and offer competitive interest rates. Truist Bank also has competitive fees for its insurance services.

Truist Bank Online and Mobile Banking Options

Truist Bank offers a robust online and mobile banking platform. Customers can access their accounts, transfer funds, pay bills, and more. The online banking platform is secure and easy to use.

Truist Bank also has a mobile app that provides customers with the same features as the online platform. The mobile app also allows customers to deposit checks and access their accounts from anywhere. The mobile app is available for both iOS and Android devices.

Alternatives to Truist Bank

If Truist Bank is not the right fit for you, there are a number of other banks that offer similar services. Some of the largest banks in the United States, such as Wells Fargo, Chase, and Bank of America, offer checking and savings accounts, credit cards, loans, and other services.

There are also a number of smaller regional and online banks that offer competitive rates and fees. Online banks, such as Ally and Capital One 360, offer a range of products and services, as well as excellent customer service and online banking platforms.

Conclusion

Truist Bank is a major financial institution in the United States. It offers a wide range of products and services, including checking and savings accounts, consumer and business loans, credit cards, mortgages, and more. Truist Bank also offers investment services and insurance services. Truist Bank has a network of branches and ATMs across the United States and a robust online and mobile banking platform for customers to manage their accounts.

Open Truist One Checking account and get $400 bonus after making qualifying deposits and getting the best banking features.

READ MORE: See The Best Bank Promotions Here And The Best Investing Promotions Here