Temu became so popular after it launched in USA and became the highest-downloaded shopping app worldwide six months after its launch in September 2022.

Hence there are many searches regarding how to buy Temu stock. Temu parent company is a giant PDD Holdings (NASDAQ: PDD), with a strong presence in various industries, making it an appealing choice for potential investors. And if you want to invest in Temu, you need to buy PDD Holdings stock listed on NASDAQ.

In this article, we’ll walk you through the steps of buying Temu stocks, so you can take advantage of the company’s potential growth and dividends.

About Temu

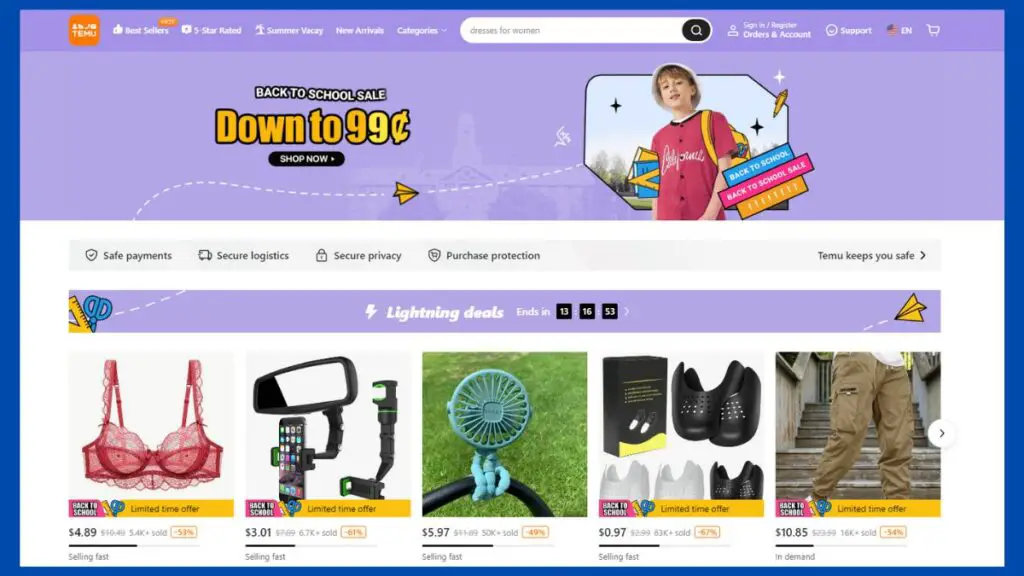

Temu is an online megastore operated by PDD Holdings (NASDAQ: PDD). Temu itself is based in Boston and offers ultra-cheap goods, including electronics and clothing, to U.S. shoppers.

Temu has seen exponential growth since it launched in September 2022, with millions of installations in the U.S. and 70.1 million U.S. unique visitors in February 2023.

Temu is not a publicly traded company, and investors cannot buy Temu stocks directly. However, investors can gain exposure to Temu indirectly through investing in PDD Holdings, the parent company.

Why Invest in Temu Stock?

Temu has achieved success as an online marketplace connecting consumers with millions of sellers worldwide.

Investing in Temu stock can be a rewarding way to grow your wealth over time, and one company may catch your eye after buying Temu stock as a diversified e-commerce and technology giant based in China.

For those who are looking for investments that align with their financial values, investing in Temu is a good option.

Are you looking to double your investments in a day, read our article on How to invest $100 and Get $1000 In A Day.

How Much is Temu Stock?

TEMU stock is known as Pdd Holdings Inc, The Temu Stock last closed at $87.60, down 1.45% from the previous day, and has increased 70.74% in one year. TEMU PDD Holdings stock is currently +125.57% from its 52-week low of $38.80 and -17.73% from its 52-week high of $106.38.

There are currently 5.28B PDD shares outstanding. The market cap of PDD is $117.99B. In the last 24 hours, 5.9M PDD shares were traded.

How to buy Temu Stock?

Temu is not publicly traded, but you can still buy Temu stocks. You can invest in its parent company, PDD.

Temu parent company is PDD Holdings, a multinational e-commerce group headquartered in Dublin, Ireland. PDD Holdings owns Temu and its sister company, Pinduoduo.

Buying Temu stock in USA is much simple; you will need to follow below simple steps:

- Choose a brokerage firm: You will need a brokerage account to access the NASDAQ market and buy PDD shares. If you don’t have a brokerage account, Webull is best.

- Open your brokerage account: Open your Webull account (15 Free Stocks).

- Add funds to your Webull account: There are multiple ways to fund your Webull account—from linking a bank account to depositing with a debit card or wire transfer.

- Search for PDD stock: Once your Webull account is set up, you can search for PDD stock by typing “PDD” into the search bar on your Webull app.

- Choose how much you’d like to invest in PDD stock: Decide if you will purchase PDD shares at the current market price or use a limit order to buy PDD stock at a specific price.

- Monitor your PDD position: Create a watchlist for important notifications, so you can monitor your PDD holding easily through the watchlist.

If you want to earn more free stocks, check out Moomoo 15 free stocks.

Is Temu Stock a Good Investment?

The Temu app, launched in September 2022, sells made-in-China products cheaply. Temu beat the top online shopping apps like Shein ans AliExpress. Temu achieved $500 million in gross merchandise value during its first five months of operation in the United States because of Temu has an attractive welcome bonus for new users Temu $100 coupon code. And the revenue shows that TEMU is making impressive financial performance, market share growth, and the strong backing make Temu a good investment.

Temu’s parent company, PDD Holdings, reported solid earnings results that indicated profitability and strong free cash flow margins. During the first quarter of 2022, PDD Holdings’ revenues increased by 58% and its net income increased by 212%.

Is Temu a Publicly Traded Company?

Where Temu is on sensation, everybody wants to know is Temu a public traded company? Temu is not a publicly traded company, and you cannot buy Temu stocks directly.

However, Temu parent company, PDD Holdings Inc., is a multinational commerce group listed on the Nasdaq stock exchange with a market capitalization of $117.99 billion. Investors can gain exposure to Temu indirectly through investing in PDD Holdings.

Frequently Asked Question

Who Owns Temu?

Temu is owned by PDD Holdings, a multinational commerce group that owns and operates Temu.

Is Temu listed on Stock market?

Temu is not listed on the Stock market, and you cannot buy Temu stock directly. However, you can invest in PDD Holding, its parent company.

How do I buy Temu shares?

Temu is listed on NASDAQ and You can buy Temu shares from any brokerage service.

Who Can Invest In Temu?

Temu is not listed on the Stock exchange, but you can invest in Temu through PDD Holdings.